Food drug device and cosmetic salvage act. Texas meat and poultry inspection act.

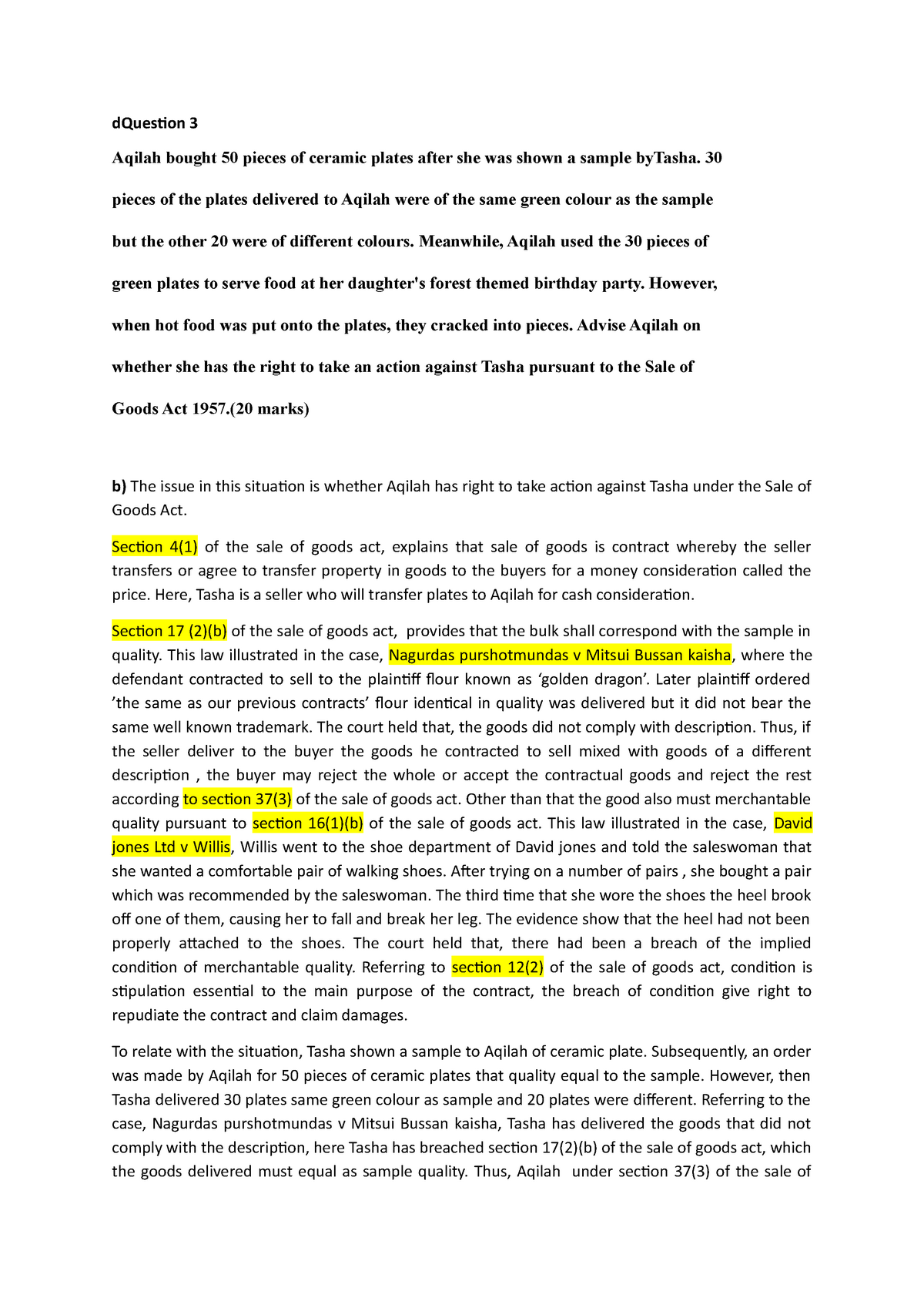

Question 3b Law446 Tutorial Work Dquesion 3 Aqilah Bought 50 Pieces Of Ceramic Plates After She Studocu

Zero-rated and exempted.

. Short title extent and commencement. Case Laws - All States. Interest payable for non-payment of tax by domestic companies.

Central Sales Tax Act 1956. As amended by Finance Act. Dramatic work includes any piece of recitation choreographic work or entertainment in dumb show the scenic arrangement or acting form of which is fixed in writing or otherwise but does not include a cinematograph film.

Short title extent and commencement. However the final consumers are the ones who pay the tax as it is passed on to them by the service providers. 1963 act required that public records be kept in accessible place at regular office and at office of town clerk or secretary of the state if no regular office exists.

Case Laws - All States. GST was replaced with the Sales Tax and Service Tax starting 1 September 2018. Central GST Act 2017 CGST Central GST.

Section - 276B. CST Registration And Turnover Rules 1957. Income Tax Act 1957 and the Karnataka Sales Tax Act 1957 to give effect to the proposals made in the Budget speech and matters connected therewith.

INTEGRATED GOODS AND SERVICES TAX ACT 2017. Penalty for failure to deduct tax at source. 10hh duplicating equipment means any mechanical contrivance or device used or intended to be used for making copies of any work 2hh duplicating.

34 Records Page 1 of 4 Section - 1. Amending Act 7 of 1997- It is considered necessary to amend the Karnataka Tax on Luxuries Hotels Lodging Houses and Marriage Halls. Pending the total removal of the Goods and Services Tax Act in parliament.

VAT tax collected at every transaction for a goods. INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. ATO Draft Goods and Services Tax Determinations 2000-.

New Zealands Sale of Goods Act was passed in 1908 by the Liberal Government of New Zealand. The Sale of Goods Act 1957 applies. 16 Records Page 1 of 2 Section - 115Q.

The Sales of Goods Act was first passed in 1896. Employment of or work by women prohibited during. Service tax is a tax charged by the government of India on specific service transactions carried out by the service provider.

12 of 1996 XVIII. Since introduction of GST the Central Government has notified a number of goods and services us 93 of CGST Act for the purpose of levy of GST under reverse charge mechanism. Texas food drug and cosmetic act.

Obtained from LA Bill No. Short title extent and commencement. Central GST Act 2017 CGST Central GST.

In this article we are discussing such goods and services which have been notified by the Central Government for the purposes of RCM. Central GST CGST. Central GST CGST.

List of Goods under RCM in GST. Patents 1957-Intellectual Property Office of New Zealand - Trade Marks 1954-Motor Vehicles Disputes Tribunal of New Zealand 1988-. Case Laws - All States.

A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn. When company is deemed to be in default. Under the act goods sold from owner to buyer must be sold for a certain price and at a given period of time Malaysia.

Service Tax was introduced under the Finance Act 1994 and is an type of Indirect tax. For the first time since 1957 the ruling partys political power was handed over to the opposition coalition. 1967 act excluded certain records from definition of public record for disclosure purposes and required public agencies to keep records of proceedings.

Optional hospital district law of 1957. CST Registration And Turnover Rules 1957. Central Sales Tax Act 1956.

Income Tax Department Tax Laws Rules Acts Maternity Benefit Act 1961 Choose Acts. Effective from 1 June 2018. Case Laws - All States.

Supreme Court of the Australian Capital Territory - Court of Appeal 2002-. Over-the-counter sales of ephedrine pseudoephedrine and norpseudoephedrine. CENTRAL GOODS AND SERVICES TAX ACT 2017.

Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars.

Sale Of Goods Act 1957 Act 382 Mphonline Com

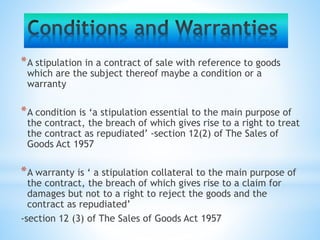

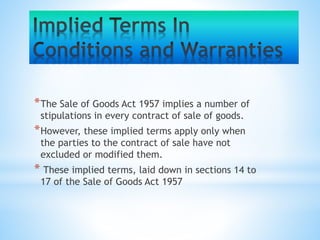

Sale Of Goods The Sale Of Goods Act

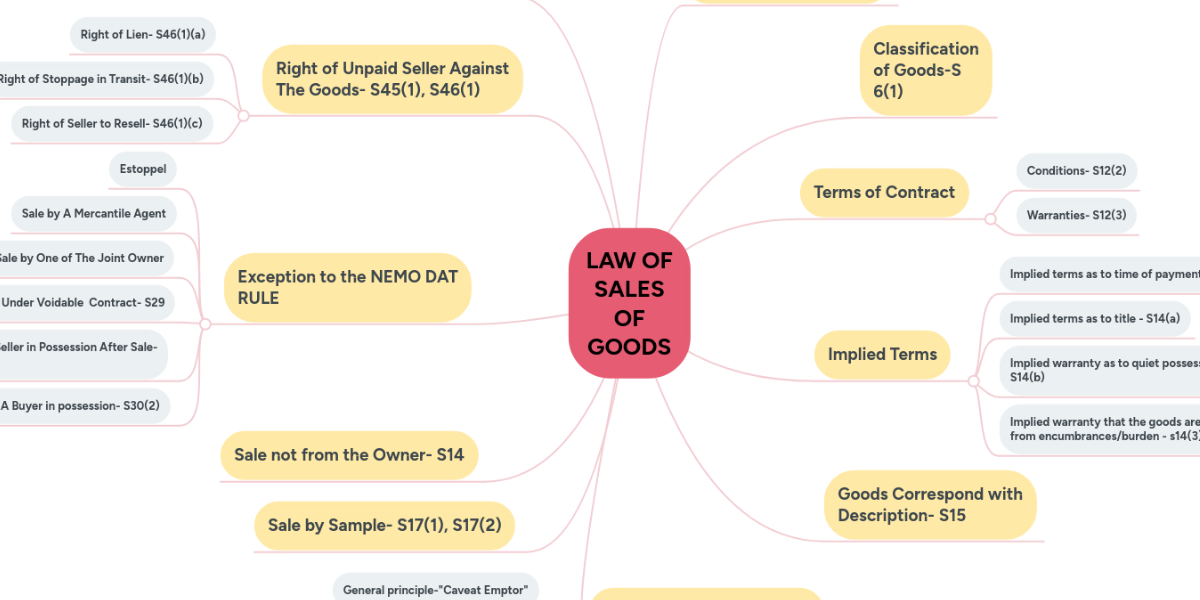

Law Of Sales Of Goods Mindmeister Mind Map

Ppt Sale Of Goods Powerpoint Presentation Free Download Id 5368573

Prepared For Law 251 Prepared By Ppt Download

The Sale Of Goods Act 1957 And The Contracts Act 1950 Bg201 Business Law Ucsi Thinkswap

Sale Of Goods Act 1957 Act 382 As At 25th March 2021 Shopee Malaysia

Ppt Law Of Sale Of Goods Powerpoint Presentation Free Download Id 3803555

Sale Of Goods Act 1957 Pptx The Law Of Sale Of Goods Introduction The Contract Of Sale Of Goods Is Governed By The Sale Of Goods Act 1957 Course Hero

Sale Of Goods Act 1957 Act 382 Marsden Professional Law Book

Sales Of Good Answer Sc 1 1ii Pdf Property Sales

Pdf Sale Of Goods Laws Of Malaysia Sale Of Goods Act 1957 Badegg Beng Academia Edu

Doc Business Corporate Law Sale Of Goods Dr Seow Hock Peng Academia Edu

Solved Tutorial 5 Sale Of Goods Question 1 What Do You Chegg Com

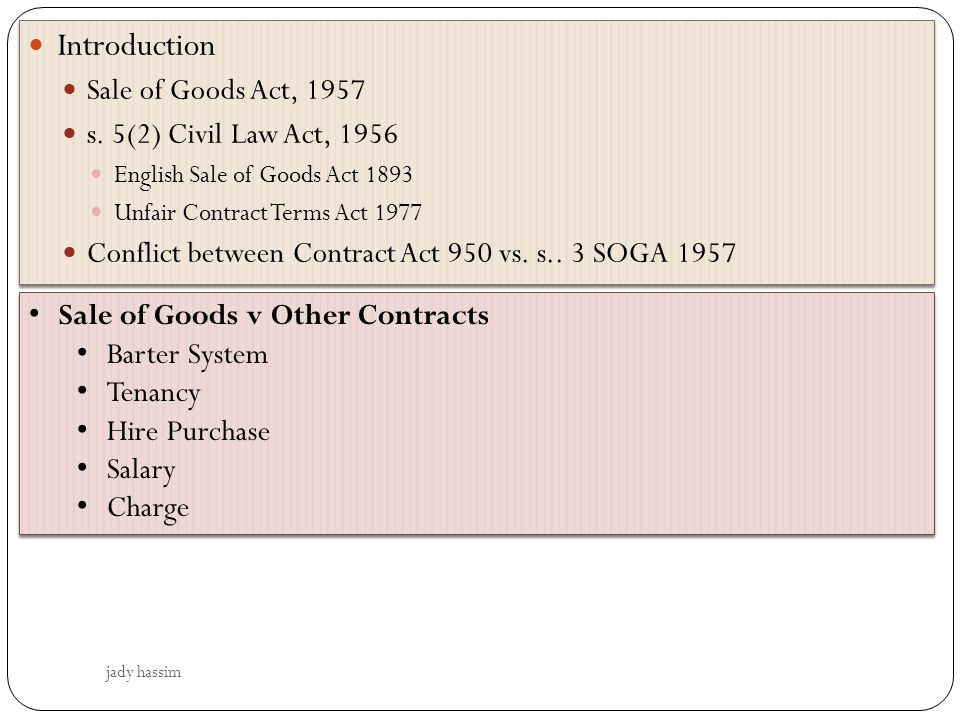

Sale Of Goods Jady Hassim Ppt Video Online Download